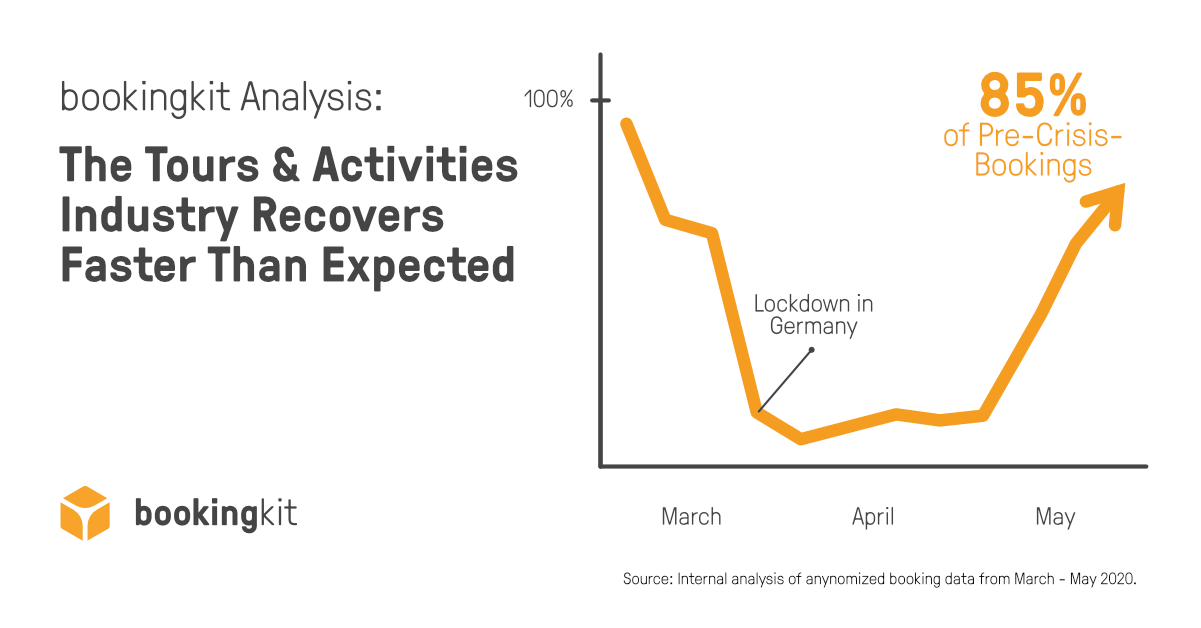

Promising Outlook: The Tours & Activities Industry Recovers Faster Than Expected

bookingkit data analysis shows: the gradual loosening of restrictions has had a marked and positive effect, with bookings partly returning to pre-crisis levels within two months, representing a U-curve in sales by outdoor providers.

Berlin, June 4, 2020 – bookingkit, Europe’s leading SaaS solution for the leisure and experience industry, provides the first analysis for this industry based on booking data from the last three months in Germany, Austria, Switzerland (DACH), Italy and France – which present a promising image. This is because the bookingkit data show that certain segments within the Tours, Activities & Attractions industry are recovering faster than expected since Germany in particular is beginning to open up again.

According to the data, providers of outdoor experiences such as water sports, high rope courses, climbing parks, amusement parks, boat trips and various kinds of small group courses providers have performed particularly well during the recovery phase after the lockdown. Although the industry is still in the midst of reopening, many of these companies have already achieved booking rates in the past two weeks that are comparable to pre-crisis figures (i.e. beginning of March 2020). Between all providers mentioned, they have on average reached 85% of their booking level before the lockdown.

This trend is also in line with developments observed in Asian markets after the lockdown, when demand exceeded supply in many areas. According to bookingkit data, more and more classic U-shaped turnover curves are now also emerging, especially in the DACH region, i.e. a sharp decline and subsequent lack of bookings is now being followed by an equally rapid increase. While this once again clearly illustrates the effects of the corona crisis, it also provides clear grounds for optimism.

“Our figures show: If an industry is allowed to reopen, this is also directly reflected in the bookings by end customers. And that is good news for the entire experience sector”, explains Lukas C. C. Hempel, Managing Director of bookingkit. Other market partners provide similar experiences: The search volume is already at pre-crisis level, even if booking behaviour is still lagging behind. “End customers are currently more in the “inspiration mode” and are booking their tours & activities for the autumn. However, the largely positive mood could accelerate this effect in the future”, Hempel continues. He added that this is not only desirable for the survival of individual providers, but also crucial for the attractiveness of cities, regions and entire countries as tourist destinations.

bookingkit has calculated that – should the current trend continue – many of the providers in the aforementioned sectors will be able to reach pre-closure sales levels by the beginning of July. This, however, requires that they be technically prepared to meet all legal & sanitary requirements and able to take advantage of the momentum in demand through a correspondingly broad range of marketing channels.

In many countries, on the other hand, it is not yet possible to reopen the experience sector as comprehensively. In France and Italy, for example, stronger government regulations and restrictions still apply. This means that the recovery here will be delayed.

For the analysis, the software company bookingkit evaluated anonymous booking data in the period March, April and May 2020.