Increasing conversion rates with the right online payment platform

Tips & Advice

Nowadays, the internet plays a major role in the preparation and organization of trips. Even before leaving for the trip, 26% of travelers book cultural and leisure activities online. If we then consider that 18% of bookings are made directly on the provider’s website. We are left with no doubt that optimizing the shopping experience on your platform is crucial to securing a good number of tickets sold. However, optimizing the online booking experience is not always a bed of roses. In fact, not everyone who visits your site will conclude the ticket purchase. One of the most critical and delicate stages of the customer journey is the payment stage. This is precisely where you see a significant drop in the conversion rate.

In this article we will look at how to increase your conversion rate by focusing on the final stage of the purchase and booking journey. For that, we will also clue you in on the importance of having the right online payment platform.

The nightmare of cart abandonment

According to data, the number of people globally who regularly shop online is around 2.14 billion. That makes it nearly 28% of the entire global population. Interestingly enough, when shifting the gaze from the world of ecommerce in the broader sense to the world of travel and tourism activities. Research also shows that 60% of leisure travel and 41% of business travel arrangements are made online. Faced with this new reality, the market responds, and while in 2010 only 25% of operators used reservation technology. Don’t forget the number significantly increased to 71% in 2019, and since then has steadily risen. All in all, these figures fit into the global trend in which world’s travel and Internet bookings exceed $500 billion.

Thus, taking into account the numbers, being present on the web and cultivating a digital presence is of undeniable importance to businesses, particularly for those in the tourism business sector. In fact, for the touristic industry, whose goal is to increase the number of tickets sold, focusing on improving the purchase experience online has become mandatory. The challenge there: fighting against shopping cart abandonment.

How to fight shopping cart abandonment

As online shoppers, we all know that before clicking on the “Pay Now” button, we take several steps. In this case the more the merrier motto does not apply (at all). In fact, the more steps it takes to finalize our purchase, the bigger the chances of getting distracted, confused, and losing interest and enthusiasm. Moreover, while all the steps in the purchase funnel are delicate, the moment of payment is particularly sensitive. It requires a financial commitment from the shoppers’ side. Thus, at this point, consumers frequently feel discouraged from completing the purchase and the cart abandonment goes up. “Frequently”? Yes, you have not misread it.

The most recent data shows us that the average cart abandonment rate in ecommerce is almost 70%! This pill is hard to swallow, but fortunately, you can count on us to tell you how to fight against this reality. In this article, we will see together how to increase conversion rate. How to close the gap between picking an item or service online and fully purchasing it, thus increasing your business sales.

Read on to find out how to improve your conversion rate and overcome the checkout hurdle.

How to improve conversion rate

First thing first, let’s make sure we are on the same page regarding the meaning of conversion rate. For the purposes of this article, we understand conversion rate as the percentage of total visitors to your site who complete the checkout process, purchasing a ticket to your facility or business.

Therefore, when aiming at increasing conversion rates in the traveling industry, it is a priority to analyze the needs of digital tourists. Also to understand how they move through your site. Finding answers for questions such as:

- “What does my client expect when it comes to checking-out?”

- “What are the disruptive elements that deter my customer from completing the purchase?” are of utmost importance. These will allow you to consider important factors of your online payment platform. That is highly dependent on the support platform you chose. Thus, below are some of the top features you should consider when picking an online payment system.

A more intuitive and responsive UI

After online shoppers decide which item or service to book, the steps that follow and lead to completing the purchase should be simple and intuitive. In fact, as human beings, we tend to look for simple, straightforward, and uncomplicated solutions. And let’s face it, picking an experience from the many that are offered, is not an easy task. Thus, after finally choosing the one, we as consumers, just hope for the transaction process to be easy. Elements such as the number of clicks to be made, how many fields to fill in, and the speed at which the purchase page loads may affect browsing time and effort. Ultimately risking leading the user to frustration.

To avoid such unpleasant feelings, betting on an intuitive and responsive payment UI is definitely one of the highest levels to focus on. The clearer the interface and the fewer actions it requires of the user, the more likely he or she will finalize the booking. Coupling to that, details such as easily interpretable icons, clear error messages and a comprehensive order summary all contribute to making the payment phase less irritating.

Finally, bear in mind that more and more purchases are made via mobile devices, thus optimizing the checkout page for this purpose can pay big dividends.

Alternative online payment platforms

Offering alternative payment methods is another important factor that can help improve your conversion rate. Here, you must consider that each person usually has preferred payment methods. It depends on many aspects, including on what they are most used to and what is more more widely spread in their region. Thus, make sure you offer alternatives consistent with the most popular methods not only locally, but also internationally. In Europe, for instance, where Digital Wallet is becoming increasingly popular. It is a wise idea to rely on a provider that supports systems such as Samsung Pay and Apple Pay, not to mention the ubiquitous PayPal. On the other hand, keep in mind that some users are still a bit more reluctant to rely on digital media. In those cases, giving the option of choosing methods such as bank transfer can be a winning strategy.

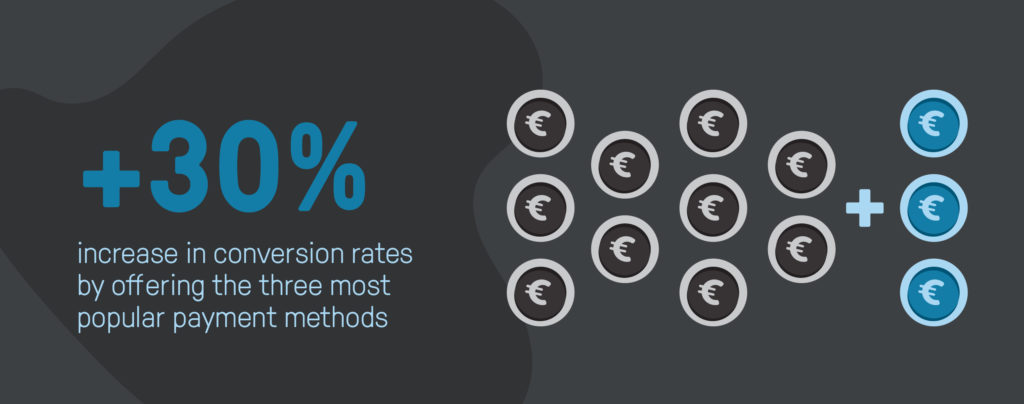

To better understand what we are suggesting here, let us share with you the numbers: offering the three most popular payment methods in a given market can improve conversion rates by up to 30%, so pay special attention to this point!

Lastly, after settling on which payment methods to offer, we recommend you monitor metrics such as conversion rate over time. This will help you evaluate whether you need to add new methods or eliminate existing ones. This flexibility to add or remove payment methods is, however, highly dependent on your provider. It should offer you the option to make these changes quickly and smoothly.

Build customer trust

Exactly for being sensitive data, asking for personal and payment method information requires strong trust from the user’s point of view. A lack of it can, within seconds, put a stop to a successful purchase. Thus, you and your provider should therefore effectively communicate that transactions are handled securely. Make the users feel their sensitive data are in good hands.

Moreover, usability and broader interface design also contribute to trust building. So as to reassure even suspicious shoppers, make the most of official icons and logos proofing to SSL encryption.

Finally, giving users the option to choose a preferred payment method, as we have seen above, will also increase the feelings of security and trustworthiness toward your company.

At the end of the day, trust toward the payment platform will automatically reflect on your site and your business, bringing conversions and sales up.

The case of Stripe

Choosing the right provider means finding the online payment platform that meets all the needs listed so far, from user interface, to choice of methods, ending with security checks.

Among the many payment methods in the market, in this article we will highlight Stripe, given its high quality and reliability.

Stripe is an Irish-American financial SaaS company founded in 2010 in Palo Alto. It now counts on more than a million customers worldwide, including Booking.com, Salesforce, Shopify, Asos, and so many others. Stripe successfully aims at removing the main stumbling blocks to online shopping. Therefore, present in 120 countries, this platform supports all major payment methods, including:

- Credit and debit cards;

- Digital wallets;

- Debit and bank transfers;

- Recurring bank debits;

- Deferred payments;

- Vouchers;

- Currencies.

Plus, it offers customizable interfaces that are easy to implement and to use by the end customer. Thus, if you are still indecisive about which online payment platform to choose from, we highly recommend you give Stripe a chance.

Conclusion – Finding the right online payment platform

By focusing on improving your online booking system with a focus on the online payment platform – you will make the checkout phase simpler and more intuitive for your users. Also you will decrease the risk of cart abandonment and consequently increase sales.

To address the critical issues associated with this sensitive stage of the conversion funnel, choosing the right payment platform is a rather important step that will enable you to deliver a smooth, fast and secure customer experience.